Our financial performance

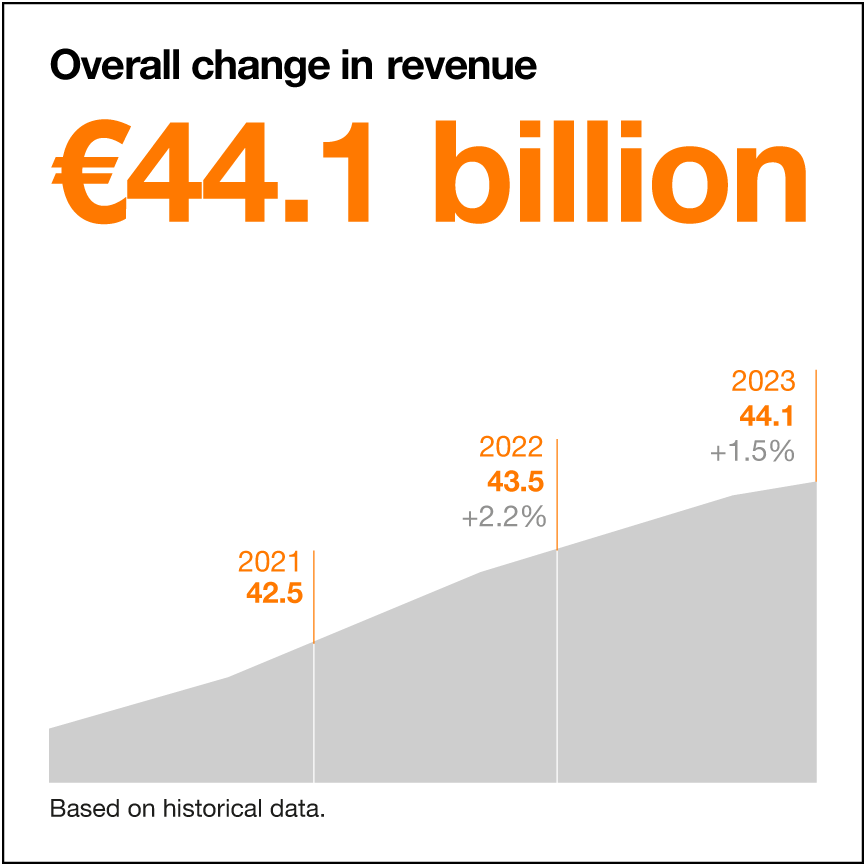

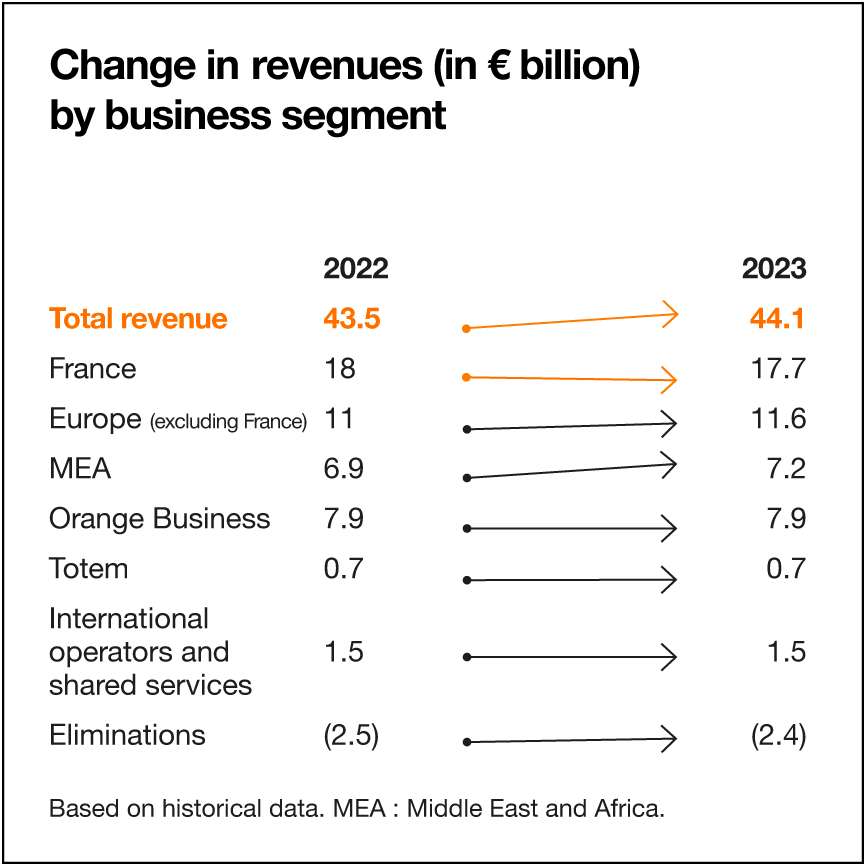

In 2023, our revenues totaled €44,1 million, up 1.8% year-on-year¹. In Europe, our value strategy and price increases are bearing fruit. Revenue growth remains strong (+2.2% to 11.6 billion euros), driven by performances in Poland (+3.9%), Belgium and Luxembourg (+4.6%). Retail services revenues continue to grow (+3%). Growth in IT and integration services (+16%) and equipment sales (+11.1%) offset the drop in revenues from operator services (-8%). Spain, for the first time since 2018, reported a 1.1% increase in revenues.

In France, our value strategy took full effect in the 2nd half of 2023, with growth in retail services excluding PSTN (+3%) partially offsetting the expected decline in revenues from operator services (-8.5%). Revenues totaled €17.7 billion, down 1.4%.

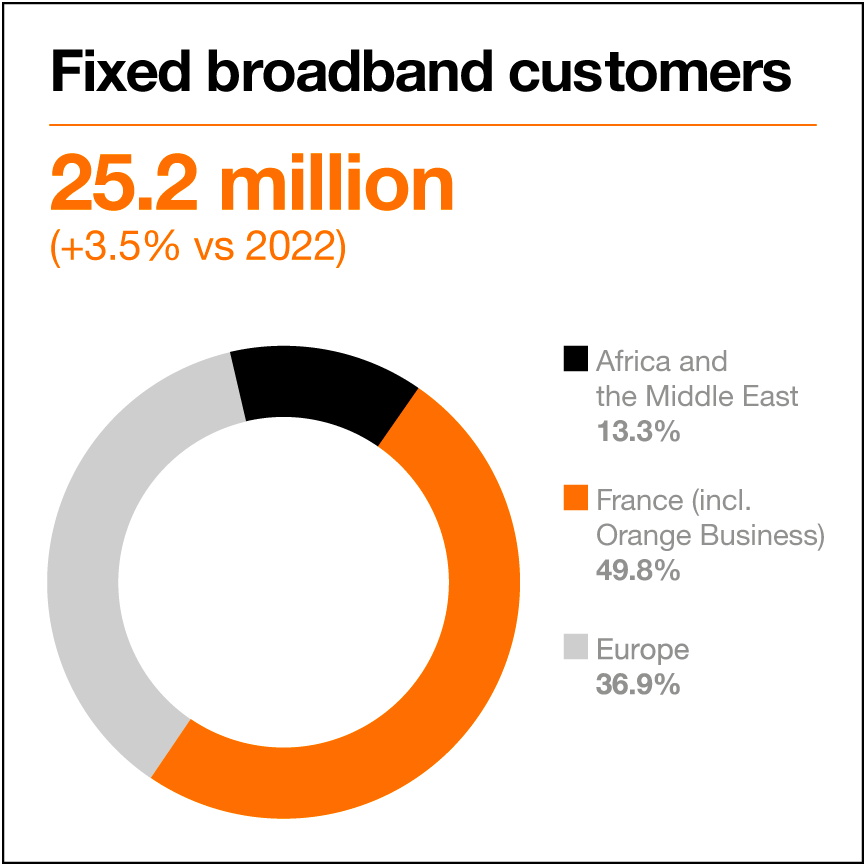

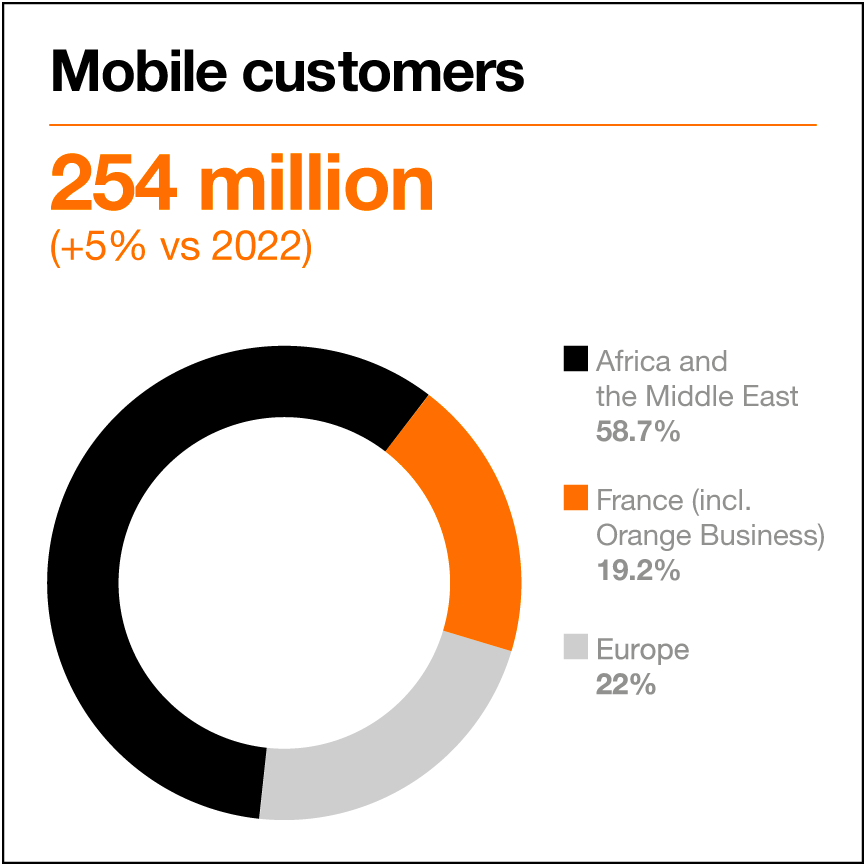

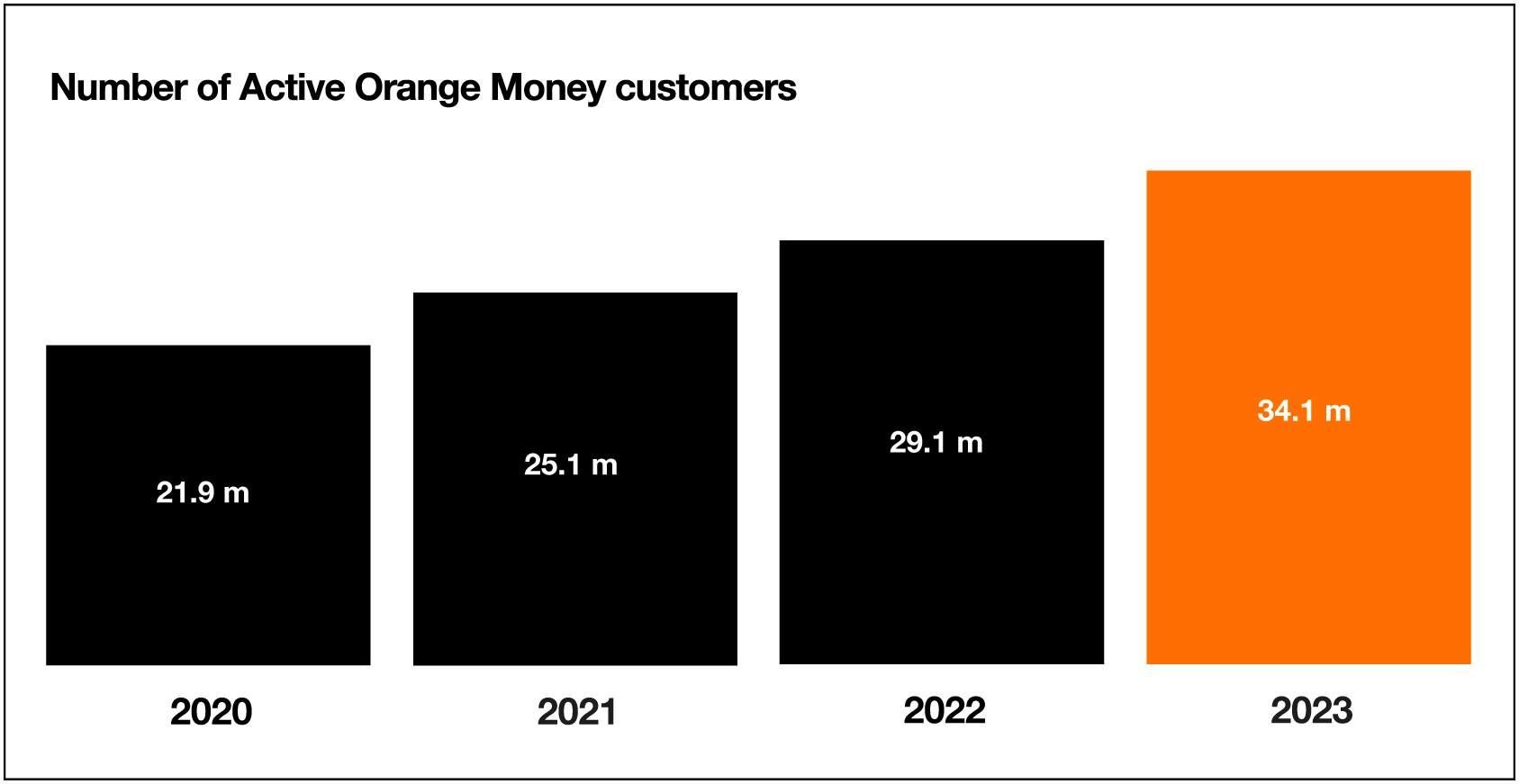

The Africa and Middle East regions confirmed their excellent performance (+11.4%, to €7.2 billion), driven by mobile data (+17.7%), fixed broadband (+16.7%), Orange Money (+25.8%) and BtoB (+16.4%). Orange Business maintained its revenues (+0.2%, to €7.9 billion). The performance of IT and integration services (+6.3%) was driven by Digital and Data (+7.2%) and double-digit growth from Orange Cyberdefense (+10.9%, to €1.1 billion).

Our operating efficiency program, with around €300 million of savings achieved by the end of 2023, is on track to reach its target of €600 million in 2025 on the basis of costs of around €12 billion at the end of 2022 and after the integration of Voo.

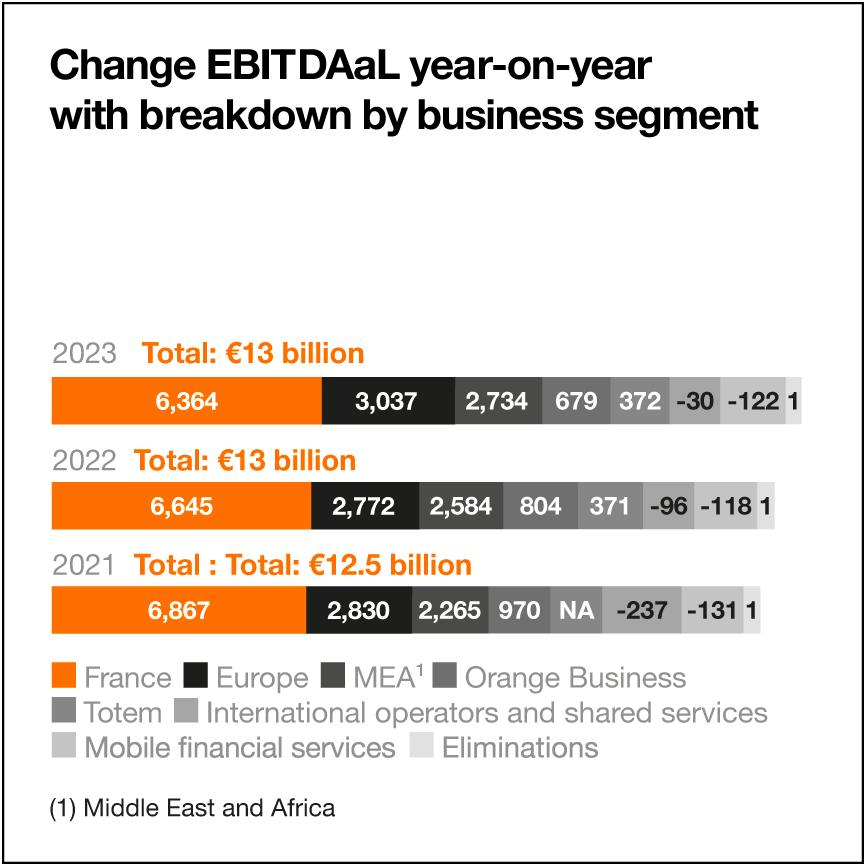

Our EBITDAaL, in line with our annual target, reached €13 billion, up 1.3%. This increase contributed to a 6.6% rise in operating income to €4,969 million.

Combined with higher financial expenses and lower tax charges, this operating income enabled us to post a 10.5% increase in consolidated net income to €2.9 billion.

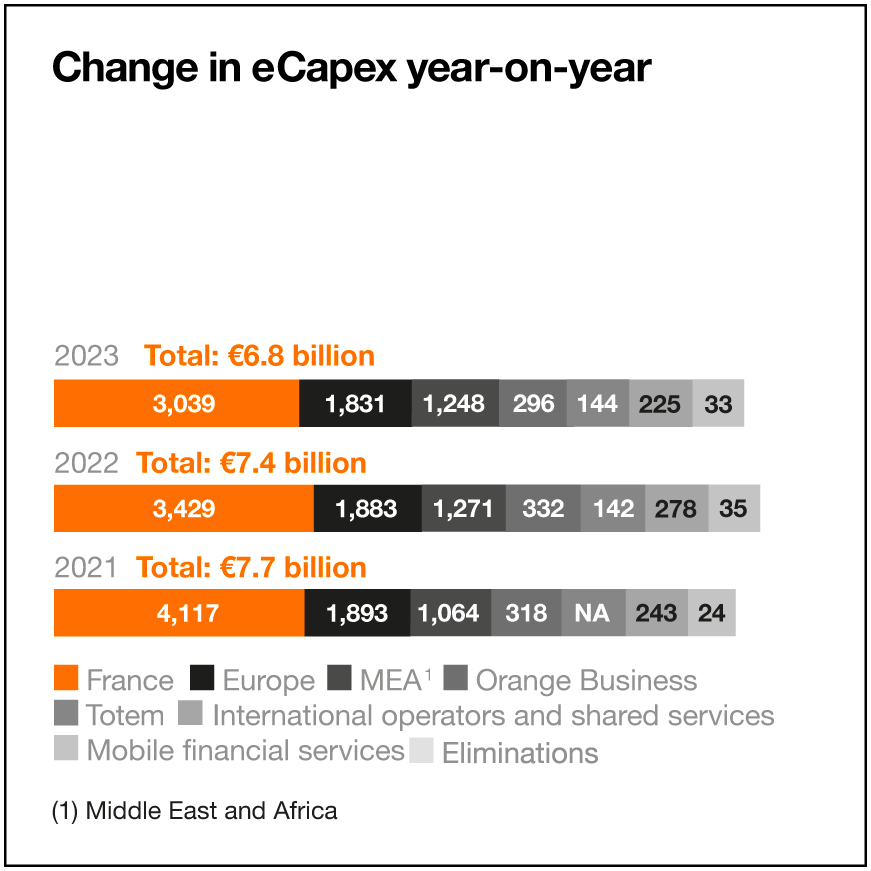

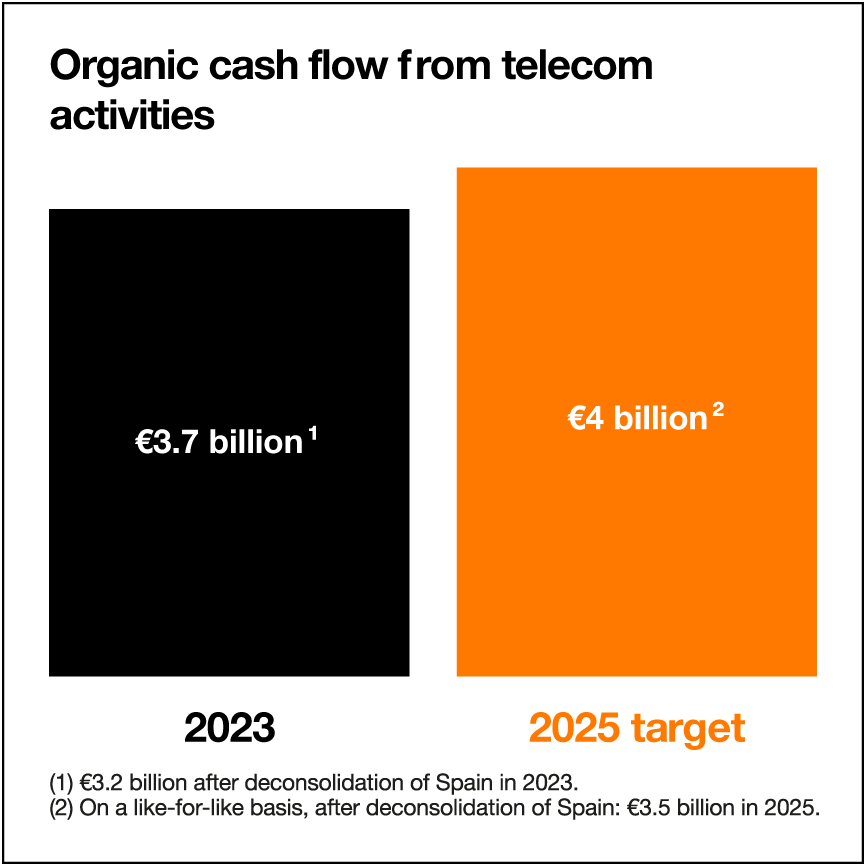

Our eCAPEX totaled €6.8 billion, a fall of 6.7%. This sharp reduction, combined with annual growth in EBITDAaL, enabled us to achieve organic cash flow from telecoms activities of €3.7 billion (+19.7% on a historical basis), in line with our target of at least €3.5 billion by 2023.

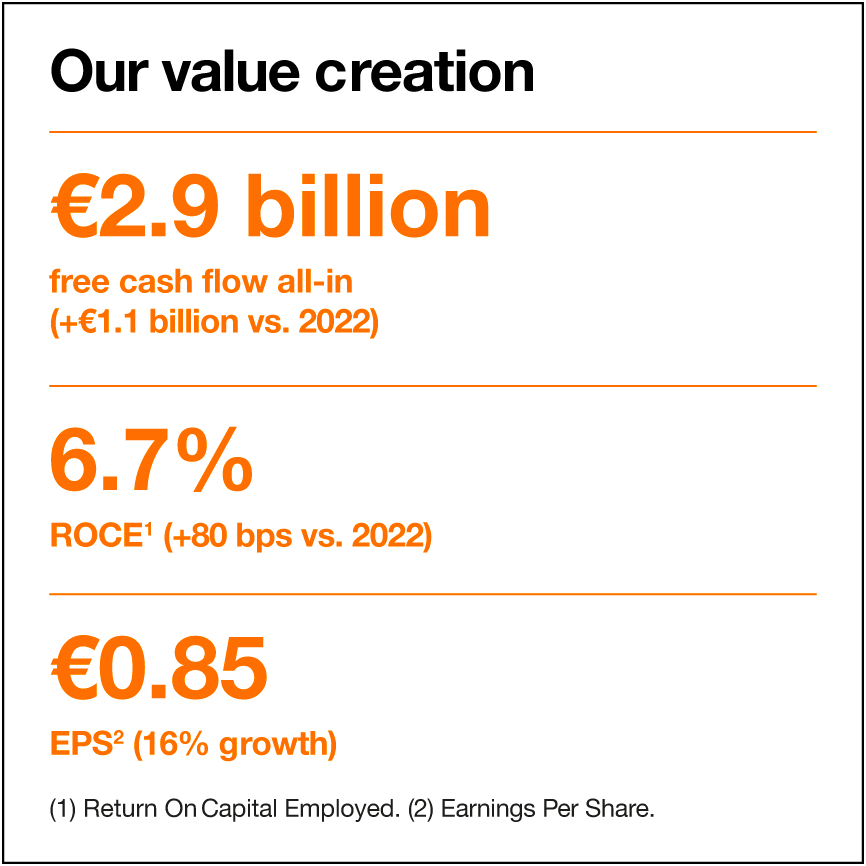

Finally, value creation, the pillar of our Lead the Future plan, is demonstrated by three indicators: free cash flow all-in (€2.9 billion), our ROCE² (6.7%) and EPS³ (€0.85).

(1) Unless otherwise stated, changes are on a comparable basis.

(2) ROCE: Return on Capital Employed.

(3) Earnings per share.

“In 2023, we achieved all our financial targets fixed for the year.”

Orange, a global digital player

- Europe: Belgium, France, Luxembourg, Moldova, Poland, Romania, Slovakia, Spain.

- Africa and the Middle East: Botswana, Burkina Faso, Cameroon, Central African Republic, Côte d’Ivoire, Democratic Republic of Congo, Egypt, Guinea, Guinea-Bissau, Jordan, Liberia, Madagascar, Mali, Mauritius, Morocco, Senegal, Sierra Leone, Tunisia.

298 million customers

Number of homes connectable to FTTH (Fiber to the Home) in the world

2021: 56.5 million

2022: 64.9 million

2023: 71.7 million

2025 Target : 69 million

of which deployed by Orange in Europe (including FiberCos deployments in France and Poland)

2021: 42.3 million

2022: 45.9 million

2023: 48.9 million

of which in Africa and the Middle East

2021: 2.4 million

2022: 3.2 million

2023: 4.1 million

2025 Target : 5.2 million

Net results

2023: €2,892 million

2022: €2,617 million

2021: €778 million

Evolution of the asset portfolio in 2023

- Acquisition of MásMóvil, Expertime, 75% of VOO by Orange Belgium

- Sale of Orange Cinéma Série (OCS) and Orange Studio to the Canal+ Group