Better identification of our sustainability risks to seize opportunities

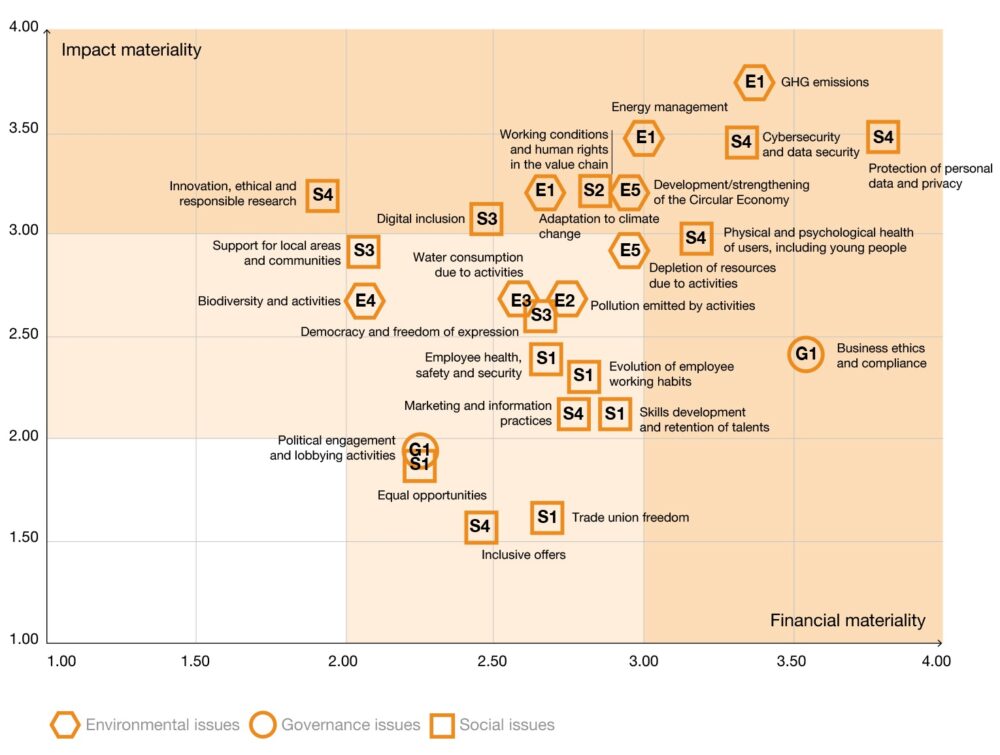

Stakeholder dialog enables us to assess the priority issues for all our stakeholders and their impact on our business and reputation. This is reflected in the materiality matrix, which helps us to reflect on our decisions and strategies by integrating the concerns and expectations expressed by our stakeholders.

In 2023, we enhanced our understanding of our sustainability challenges by producing a double-materiality matrix. Our work was based on our simple materiality matrix carried out the year before, which we enhanced with our risk mapping and international standards and benchmarks. This approach was carried out collectively by a working group bringing together expertise from different business departments (CSR, Strategy, Innovation, HR, Finance, Risk) and geographical regions (Europe, Africa, Middle East), with the support of a specialized external firm. The double-materiality matrix enabled us to identify our financial risks and opportunities, as well as our positive and negative impacts on sustainability issues.

Our 2023 double materiality matrix

The double-materiality matrix has enabled us to identify 25 issues, 12 of which are material (located in the dark orange section). Those placed furthest to the right of the matrix are the most critical in terms of business continuity or financial impact for Orange. Those at the top are considered to have the most significant impact on stakeholders.

25 sustainability issues analyzed from a dual perspective

Impact perspective

This involves looking at the impacts (positive and negative, real or potential) of Orange’s activities and organization on people, society and the environment. For each issue, the following elements were assessed: severity, magnitude, scope, remediability and probability of occurrence. This led to the definition of the matrix below.

Financial perspective

The risks and opportunities associated with these sustainability issues, which could have a positive or negative impact on Orange’s business model, development, performance and position in the short, medium or long term, were analyzed. For each issue, the financial valuation was based on the criticality of the issue in terms of business continuity and Orange’s dependence on its business relationships. Lastly, various industry standards were used to refine the assessment of impacts (GRI G4 standard, ENCORE tool, GSMA framework, etc.) and risks and opportunities (ISSB, SASB standards, etc.).